| Period | Interest Rates |

| 91 – Day | 14.6908% |

| 182 – Day | 15.1122% |

Short-term Government of Ghana (GoG) Treasury bill rates continued to mount an upward pressure on the short-term end of the yield curve as both the yield on the 91-day and the 182-day bill rose this week to build on previous weeks’ gains. The rise comes on the back of investors’ expectation of higher inflation as the Cedi continues to remain under pressure.

The yield on the 91-day bill gained 6 basis points (bps) this week to build on previous week’s 3 bps gain. It rose from 14.6263% recorded last week to 14.6908% this week, its highest since the first week in May, 2017.

The yield on the 182-day bill also hardened by 3 bps to build on previous week’s gains. It rose from 15.0865% posted last week to 15.1122% this week, its highest in 89 weeks.

Week on week changes for 21st January, 2018

| 14-Jan-19 | 21-Jan-19 | CHANGE | PERCENTAGE CHANGE | |

| 91 – Day | 14.6263% | 14.6908% | 0.0645 | 0.4410% |

| 182 – Day | 15.0865% | 15.1122% | 0.0257 | 0.1704% |

Auction results from Bank of Ghana (BoG) tender 1625 further showed that demand for the short-term Treasury instruments fell below the government’s expectations despite the continued uptick in the short-term Treasury instruments. Total bids tendered and accepted for both the 91-day and 182-day bills came in at GHC 773.32 million as against the government’s target amount of GHC 823.00 million.

Next week, the government is expected to lower its target amount to GHC 460 million for its 91 and 182-day bills. The government is also expected to raise a total of GHC 100.00 million from a 364 day bill.

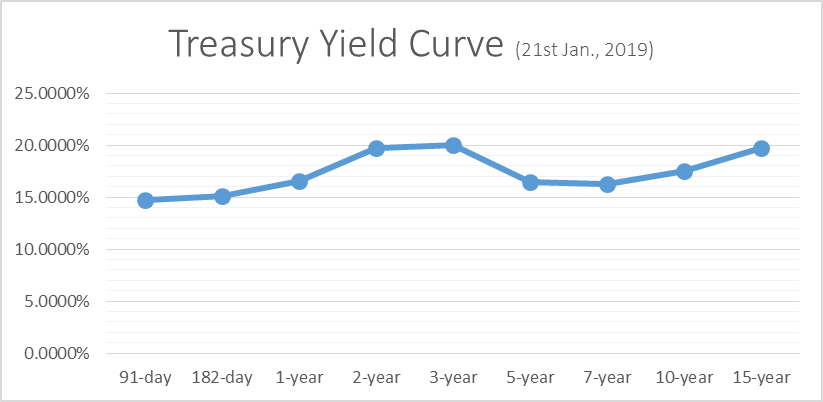

The Treasury Yield Curve

Honey14

are you struggling to get comments on your blog?