| Period | Interest Rates |

| 91 – Day | 14.7714% |

| 182 – Day | 15.2264% |

| 10 – Year Fixed Rate Bond | 19.8000% |

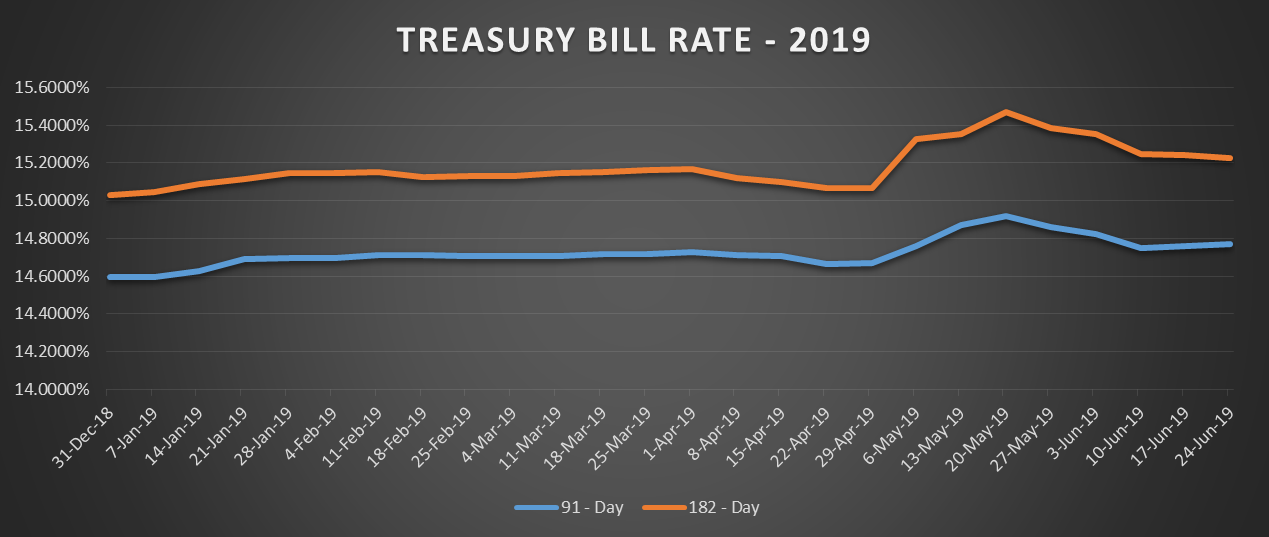

Short-term Government of Ghana (GoG) Treasury bill rates posted a mixed performance this week, building on previous week’s mixed performance. After posting a recovery from weeks of a tumbling performance, the 91-day bill remained resilient as it built on previous week’s gain. The yield on the 182-day bill failed to impress as it extended its losing streak to five consecutive weeks of losses. This week’s treasury yield performance comes after the consumer price index recorded its first dip following three weeks of consecutive tightening. Data released by the Ghana Statistical Services indicated that the inflation rate for May, 2019 fell from 9.5% to 9.4%.

The yield on the 91-day Treasury bill strengthened by 1 basis point (bps) this week to build on previous week’s 1 bps gain. It rose from 14.7567% posted last week to 14.7714%.

The yield on the 182-day bill fell by 2 bps to build on previous week’s marginal drop. It weakened to 15.2264%, its lowest since end-April, 2019 from 15.2436% posted last week.

Week on week changes for 24th June, 2019

| 17-Jun-19 | 24-Jun-19 | CHANGE | PERCENTAGE CHANGE | ||

| 91 – Day | 14.7567% | 14.7714% | 0.0147 | 0.0996% | |

| 182 – Day | 15.2436% | 15.2264% | -0.0172 | -0.1128% | |

Auction results from Bank of Ghana (BoG) tender 1647 further showed that demand for the government’s short-term Treasury instruments failed to beat expectations after weeks of strong demand for the 91-day, 182-day, and 364-day bills.

Total bids tendered for both 91-day and 182-day bills came in at GHC 741.57 million against the government’s target amount of GHC 934.00 million. The government accepted all bids tendered.

As part of its issuance calendar for the second quarter of the year, the government issued a 10-year fixed rate bond. Demand for the longer-dated paper was strong as total bids tendered came in at GHC 503.95 million against the government’s target amount of GHC 300.00 million. The yield on the 10-year bond came in at 19.8000%, gaining 230 bps from 17.5000% recorded a year ago.

Next week, the government is expected to decrease its target amount to raise a total of GHC 875.00 million from 91-day, 182-day, and 364-day bills.

2019 91-Day and 182-Day Bills Trend